Hello Readers! How are you all?

Novice investors who are new to the investment sector prefer to invest in low-risk funds, as they are reluctant towards losing their money. Similarly, the senior citizen also restricts themselves from investing in high-risk mutual funds, and invest in low-risk mutual funds, as they want to earn optimal returns in short investment tenure, and at the same time also wants to secure their money.

A newbie investor has very less knowledge about the market, and different fund schemes, so in order to find the low-risk mutual funds, they would have to go with a long and detailed analysis process, that can be a bit difficult for them. Well, if you are also a novice investor, and is in search of low-risk mutual funds to start investing, then today we are here with The Top Recommended Low-Risk Mutual Funds of 2020, where you can invest, and earn an optimal return.

What are Low-Risk Mutual Funds?

Mutual Funds are the most preferred investment structure by many financial advisors, as these offer higher returns, are more tax-efficient and provide good liquidity, than other Investment structures like Fixed deposits, Recurring deposits, and many more, but at the same time as mutual funds are market-linked investment, almost all of the schemes invariably carry a risk element, some carry high-risk, while some carry low-risk.

The Debt mutual fund is categorized as a safer investment, as these funds invest in government Bonds, Money market funds, etc. There are various debt funds like Liquid Funds, ultra-short-term funds, short term funds, dynamic bonds, gilts funds, etc., and all these funds vary in terms of risks. Out of these various debt-funds, Liquid funds and ultra-short-term funds are the lowest risk funds that are aimed at generating optimal returns for a short duration. Thus, the newbie investors with a low-risk profile can consider their investment in these funds.

Liquid Funds

The liquid fund concentrates most of its investments in short-term fixed-interest generating money market instruments. As these funds aim to generate good returns over a short period, its fund manager, mostly invest in high-credit quality debt instruments, with short-term maturities (up to 3 months or 91 days). These funds provide easy liquidity and are least volatile than the other types of debt instruments. The rate of returns offered by liquid funds varies from 7-9%.

Top Performing Liquid Low-Risk Funds to Invest in 2020

We have prepared a list of best-recommended Liquid Low-Risk Funds, for the financial year 2020, after a good analysis of different Liquid mutual funds. These funds have been selected on the basis of their past returns and performance.

Ultra-Short Term Funds

Ultra-Short-term Debt funds focus its investment in a combination of debt instruments, like treasury bills, commercial papers, certificates of deposits, and corporate bonds, that have a low maturity period, ranging from 6 months to 1 year. These funds also offer good returns with less market volatility, and newbie investors can consider their investment in these funds. This fund offers returns based on a rate of return that varies from 8-10%.

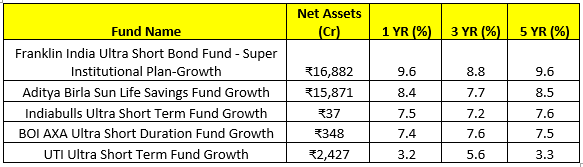

Top Performing Ultra-Short Term Funds to Invest in 2020

We have prepared a list of best-recommended Ultra-Short Term Funds, for the financial year 2020, after a good analysis of different Ultra-Short Term mutual funds. These funds have been selected on the basis of their past returns and performance.

As of now, you are aware with the low-risk funds, where one invests for short tenure and receive optimal returns with the benefit of good security to their funds, if you also want to invest for short term, then plan your investment in Liquid Funds or Ultra-short term debts and enjoy the benefits of low-risk mutual funds.

Most importantly, always consult a financial planner or advisor, before starting your investments. They will help you select the best fund, for your investments as per your requirement.

You can also contact us at Shri Ashutosh Securities Pvt Ltd., we are here to help you in any way possible.

Happy Investing!

(Mutual Fund investments are subject to market risk Illustrations are for example only, there is no guarantee of returns. Past performance is not an indicator/guarantee to future returns).