Hello Readers!

I hope you are well and staying at home.

In Equity, a bear market is considered when the prices correct more than 20% from the nearest market peak.The current correction of market prices clearly shows that we are facing a bear market since the last some weeks, and the consequences of this bear market are shown by our fund in their returns.

The Nifty 50 is currently around 28% lower than its peak in January 2020 and last month had fallen nearly 40% from this peak. This has been the condition of the market since last some weeks and the major reason behind this is the massive spread of COVID 19 and the major step taken to stop this spread that is a complete lockdown.

However, the recent recovery in market prices has created a ray of hope among the investors, regarding the recovery of the bear market.

We should also be aware of the historical experiences that clearly explain that that bear markets can continue for much longer.

Well, the market is unpredictable, and currently, we all are unaware of the fact that when will this pandemic end and when will the market get converted to a bull from a bear one. Here the most important thing that we have to understand is how we should take this bear market as opportunities that can help us to build future wealth, rather than letting our fear take it over.

BENEFIT OF BUYING IN BEAR MARKET

If you are a bull market buyer and believe that purchasing mutual fund units when the market is high is more profitable, then dear you need to understand the benefit of buying at the low market or bear market. When the market corrects itself or when the market is in its bear phase, you get the offer to buy the same mutual fund scheme or the same stock at a lower price. Buying the same quality at a lower price is like buying our favorite expensive shirt at a discounted price.

Histories have an example regarding this notion. Let us understand it.

A Large Cap Fund was launched in April 2008, just before the 2008 correction extended itself, at a NAV (Net Asset Value) of Rs 10, a year later, the price was at around Rs 6.9, that was down by 30%. In the next 6 months when the market showed some recovery, the price nearly doubled to Rs 13.

The investors, who invested in this scheme, gained the benefit of adding more units of this fund during the low market at a low price. The absolute gain since launch is 30% but from the lows, it is much more. The current NAV of the scheme is Rs 40. Hence, investors need to keep adding through a period of a downturn to take advantage of lower market levels too.

WAITING FOR THE BOTTOM?

The complete bear market phase is an opportunity to buy mutual fund schemes at a low price, and add more units to your portfolio at a low price. However when the market enters its bear phase or correct itself, what investor do first is get panic and start withdrawing their investments from the mutual funds, while some of the investors wait for the bottom phase of the market, so that they can put a lumpsum and purchase more units at a low price, but here the question arises, is it worth waiting for the bottom.

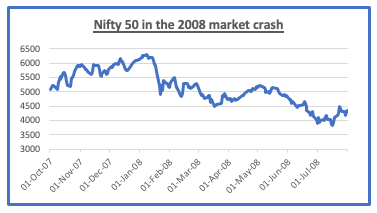

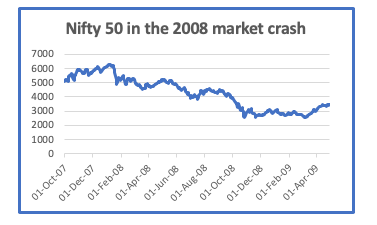

If we look at the graphs of market price ups and downs of the bear market in 2008, we can get the answers to our question so let’s have a look.

The first graph clearly shows that in mid-July 2008, the equity market benchmark index had corrected 40%, many investors may take this correction as the bottom and invest a lump sum.

The second graph shows that the market did not bottom out till October 2008 and recovery in sustainable prices started only by March 2009.

If we conclude we can say that the bottom of the market is only identified when we look back at the bear market, thus waiting for it to invest your lump sum has little sense in it. Hence to avail the benefits of the bear market you have to keep up regular investments throughout the bear phase.

Market corrections and bear phases happen due to many different reasons, and similarly, recoveries to have their reasons, what is important for investors is to hold their patience during the bear market and their excitement during the bull market.

Rather than getting panic and think of selling their investment in bear market investors must take advantage of the lower prices and keep adding in small quantities to their existing allocation to equity.

You can contact us at Shri Ashutosh Securities Pvt Ltd., for any assistance, we are here to help you in any way possible.

Happy Investing!

(Mutual Fund investments are subject to market risk Illustrations are for example only, there is no guarantee of returns. Past performance is not an indicator/guarantee to future returns).