Hello Readers!

Hope you all are fine and safe!!

We are in the third month of the year, which is March 2021. It’s time to have an overview of the events that took place in February month of 2021.

Well, before that let us know some facts about a famous Board Game, “The Landlord’s Game”. The game, first patented in 1904, was designed to protest land monopolism. The rules of the game were such that the players were rewarded when wealth was created. However, when the game was second time patented in the year 1924, the rule of the game become contrary to the first one. An interesting thing was that the game becomes more popular with the new set of rules.

The new rules were such that the players bought properties and built houses and hotels, all with the intention of bankrupting their competitors. Yes, you got it right, it’s MONOPOLY, also known as BUSINESS GAME at some places!

The patent story of this game is somewhat different from what the world knows. Well, before we hear the real patent story of the game, let us look at what and how the market played down in the month of February 2021.

Overview Of Indian Market In February 2021!

- After the spike witnessed in the bond yields last Friday, and the Biden administration’s first military action, it was expected to have a good impact of these events on the Indian Market, however, it didn’t happen. The India growth narrative is intact.

- Japanese Brokerage Nomura projected a 13.5% growth for Indian GDP for the financial year 2021, the expectation was higher than the RBI’s 10.5%. Well, that was good news for the Indian Economy.

- Well, this was the projection predicted by the Japanese Brokerage, but what IMF and S & P Global Index have projected was not different from this. Both of them quoted that India will be among the fastest-growing economies in the next fiscal. To put this in perspective, the IMF has predicted a 5.5% growth for the global economy, with the US at 5.2% and Europe at 4.2%.

- The projections predicted by S & P and Nomura were all based on the business indices across manufacturing, services, and labor-market sectors. The reports presented for the earning from FMCG companies showed growth in consumer spending on discretionary items, then compared to the previous quarter and all this was because the markets and public places were now open and thus, increasing mobility.

- The topic that was in trend after the announcement of Budget 2021, was ULIP’s and PF products because they were no longer now a financial product that will help people save tax. This year’s budget has proposed that the returns on a ULIP policy whose annual premium is greater than Rs 2.5 lakhs would be taxable as capital gains. For this new provision, the government stated that they are doing this with the perspective to keep insurance and investments separate. In the case of EPF, the proposal is to tax the interest earned on the PF balance if the employee’s contribution exceeds Rs 2.5 lakh in a year.

Now coming to the patent story of the game, Monopoly! The world knows Charles Darrow as the creator of Monopoly, who sold his game to Parker Brothers, who were acquired by Hasbro. However, this was not the complete story.

In a legal battle in the year 1970’s the truth came forward, and it was found that Monopoly’s original inventor wasn’t Darrow. It was Elizabeth J. Magie, a firebrand crusader of abolitionism and women’s rights. About her it is said when she saw that a $10 stenographer salary is not enough for her, she ran an advertisement offering herself as a slave to the highest bidder. It was her way of mocking marriage as the only option for women.

So basically, the second set of rules introduced that made the game most popular all over the world was the idea of Magie. She had patented the game twice, in an era when women held less than 1% of the patents. But while Darrow became the first millionaire game designer, Parker Brothers bought Magie’s patent for $500 and gave her zero credit for the game’s invention. After a lot of struggle and decades, her story was connected with eth story of MONOPOLY!

Well, the time changed, people changed, era changed but what doesn’t change is the dice that is still loaded against women. But it's high time, and we must aim to help change this. We feel proud to share that over a thousand rupee-millionaires on our platform are women.

We believe that an individual, whether a man or woman can manage their money in the best way, and as an expert what we can do is to continue our efforts to help level the playing field so that they can play easily.

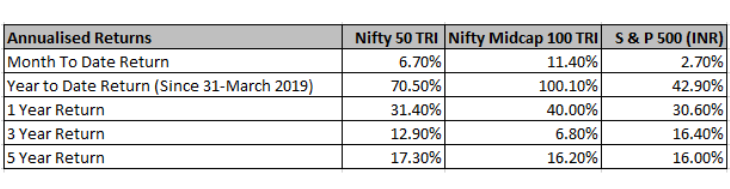

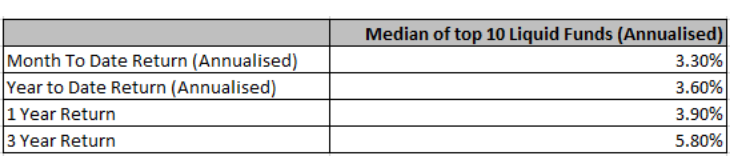

Indices And Benchmarks In February 2021!

Equity

Debt

Keep reading for more updates on Mutual Fund Investment!!

For any kind of query you can contact us at Shri Ashutosh Securities Pvt Ltd., we are here to help you in any way possible.

Happy Investing!

(Mutual Fund investments are subject to market risk Illustrations are for example only, there is no guarantee of returns. Past performance is not an indicator/guarantee to future returns).