Hello Readers!

People when they are introduced and advised to invest in mutual funds via SIP (Systematic Investment Plan), they often have a question, “how will those small shots of investment every month will help them become rich?”. You must have heard that investing regularly for the long term is the key to wealth creation, now it is a matter to think, how investing regularly for the long term can help create a good wealth, or why long-term investment is necessary for wealth creation.

Investors often look for the investment that offers the highest possible return rate, however, financial experts always advise them to invest as much as possible and as long as possible.

HOW LONG-TERM INVESTMENT HELP CREATE WEALTH?

Investing regularly for the long-term, this kind of strategy is very less followed and affected due to many things like volatility in the market, bad performance of the fund, and many others. But in the reality, this simple act of being regular with your investments can help you build a large corpus.

Let us understand this through an example.

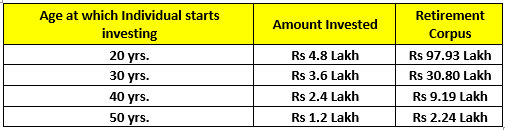

For individuals with different current age, say 20, 30, 40, and 50 years decided to invest in Equity mutual funds for their retirement. They all are going to retire when they reach 60 years of age. Each one of them decides to invest Rs 1,000 per month, a modest sum till the age of their retirement, in an equity mutual fund offering a 12 percent rate of return per year. Here the table shown below represents their corpus value that would be like when they retire.

The data clearly defines that for wealth creation, an individual has to ensure that he invest as much as possible and as long as possible. If an investor plans his investment based on these two factors, then the magic of compounding works in the favor of the investor.

These two factors, regular investment, and long-term investment always remain under the control of investors; thus, they must base their investment on these factors. However, while planning their investments most investors would instead chase the rate of return, which is not in their control.

In case if you are looking for investments, to generate a high return, then long-term investing Equity mutual funds are the end of your search. Equity mutual funds have different categories that give you the option to choose funds based on your risk capacity. They do offer diversification facilities that help you reduce the risk in your portfolio and generate good returns. Remember, Trying to invest in equity in short term increases the portfolio risk, which ultimately restricts you from creating the required wealth for your goals.

So last but not the least, individuals must focus on “Investing Regularly” and “Investing For Long-Term” if wealth creation is their investment objective.

For any kind of query, you can contact us at Shri Ashutosh Securities Pvt Ltd., we are here to help you in any way possible.

Happy Investing!

(Mutual Fund investments are subject to market risk Illustrations are for example only, there is no guarantee of returns. Past performance is not an indicator/guarantee of future returns).