Hello Readers!

Mutual Fund is the most preferred investment by financial advisors and is useful in building a good corpus for financial goals. Do you know, in mutual funds, your investment of thousands can give you returns in crore? Well, this all because of the magic of the compound interest.

We all know, returns in mutual funds are calculated on the basis of Compound interest, where not your money but the interest raised on your money also earns interest for you, amazing!

There are two famous rules in mutual funds, rule number one, 15*15*15 and rule number two, 15*15*30, these rules help an investor of mutual fund to accumulate a corpus in crores for their goals. It is said, these two rules are magic of compound interest, well, let us what is the power of compound interest, what are its rules and how do they work.

Power of Compounding

The interest in mutual funds is calculated on the basis of Compound Interest. In mutual funds, Compound interest is simply the addition of interest earned, to the principal, which is then reinvested or in other words, interest on interest. Yes, through a compound interest in mutual funds, not only your invested money earns interest for you, but rather the interest earned on your investment also earns interest for you. This is, Compound interest was named as the eighth wonder of the world by a famous scientist, Albert Einstein.

Through compound interest, your money invested in mutual funds, keep multiplying, over a period of time, and this is the reason, why it is always advised to investors, in mutual fund, early start of investment and staying invested for long, both the scenarios, are important as well as necessary, to earn a big return on your investment.

What is 15*15*15 Rule in Mutual Funds?

The rule of 15*15*15 is a very easy rule to understand and much helpful to build a corpus of 1 crore. It is said in mutual funds, that a SIP (Systematic Investment Plan) of Rs 15000 per month at an assumed CAGR (Compounded Annual Growth Rate) of 15% for 15 years can yield a return of 1 crore, on maturity, that is with a total investment of Rs 27 Lakhs, spread across 15 years can fetch its investor Rs 1 crore.

Well, here I am giving a figure that will help you to understand the 15*15*15 rule, graphically.

What Is 15*15*30 Rule in Mutual Funds?

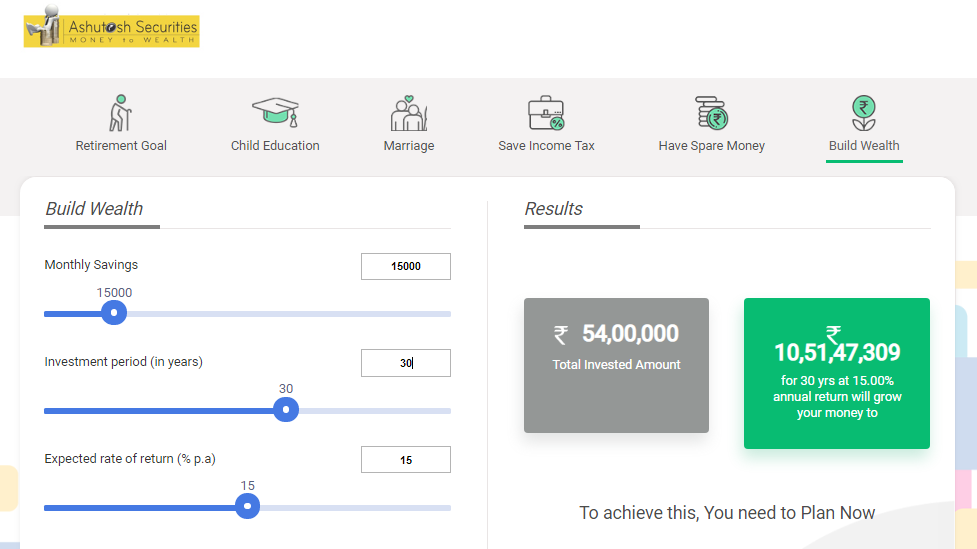

As per this rule, in mutual funds, a SIP (Systematic Investment Plan) of Rs 15000, at an assumed CAGR of 15% for 30 years, can yield a return of Rs 10 crore, on maturity, that is by increasing your investment tenure by 15 years, and with a total investment of Rs 54 Lakhs, you can create a corpus of Rs 10 crores.

Well, here I am giving a figure that will help you to understand the 15*15*30 rule, graphically.

Well, till now you must have understood why Compound interest is known as the eighth wonder of the world, and how its magic works. Do remember 15% CAGR means a 15% average return over a period of time and not a 15% annual return. One can experience a 20% return one year and -5% the next year, because of fluctuations in the market. The average will be 15% over the period of time, one has invested for.

As of now, you benefit from compound interest, I would strongly recommend, start investing through SIP in mutual funds. SIP investment not only give benefits of compounding, but it has other benefits too, like

- Rupee Cost Averaging helps the investor to buy more units when the market is low and accumulating more units will help you earn a big return.

- It creates a regular and disciplined habit of investing.

- It is easy and simple to monitor your SIP investments; you can track them in your bank statements.

- SIP’s can be stopped at any time at one’s convenience. The SIP can be paused, or the SIP amount can be increased or decreased at any time during the SIP’s tenure.

Most importantly, always consult a financial planner or advisor, before starting your investments. They will help you select the best fund, for your investments as per your requirement.

You can also contact us at Shri Ashutosh Securities Pvt Ltd., we are here to help you in any way possible.

Happy Investing!

(Mutual Fund investments are subject to market risk Illustrations are for example only, there is no guarantee of returns. Past performance is not an indicator/guarantee to future returns).