The last 2 months have been tough for equity market investors. Especially for the investors of the long term, waiting for such a long period to get such bad returns was never expected and is kind of the worst nightmare for any investor.

This time is no doubt stressful and painful.

The situation now is not very common but they are not impossible. Situations have been critical in the past too. The point is how to build hope in this time of hopelessness, the key is in the past.

As this is not the first time the market has gone down, in past to the market it has been down and things have been not well. Let us see what happens when the investors decided to continue with their SIPs for a little longer.

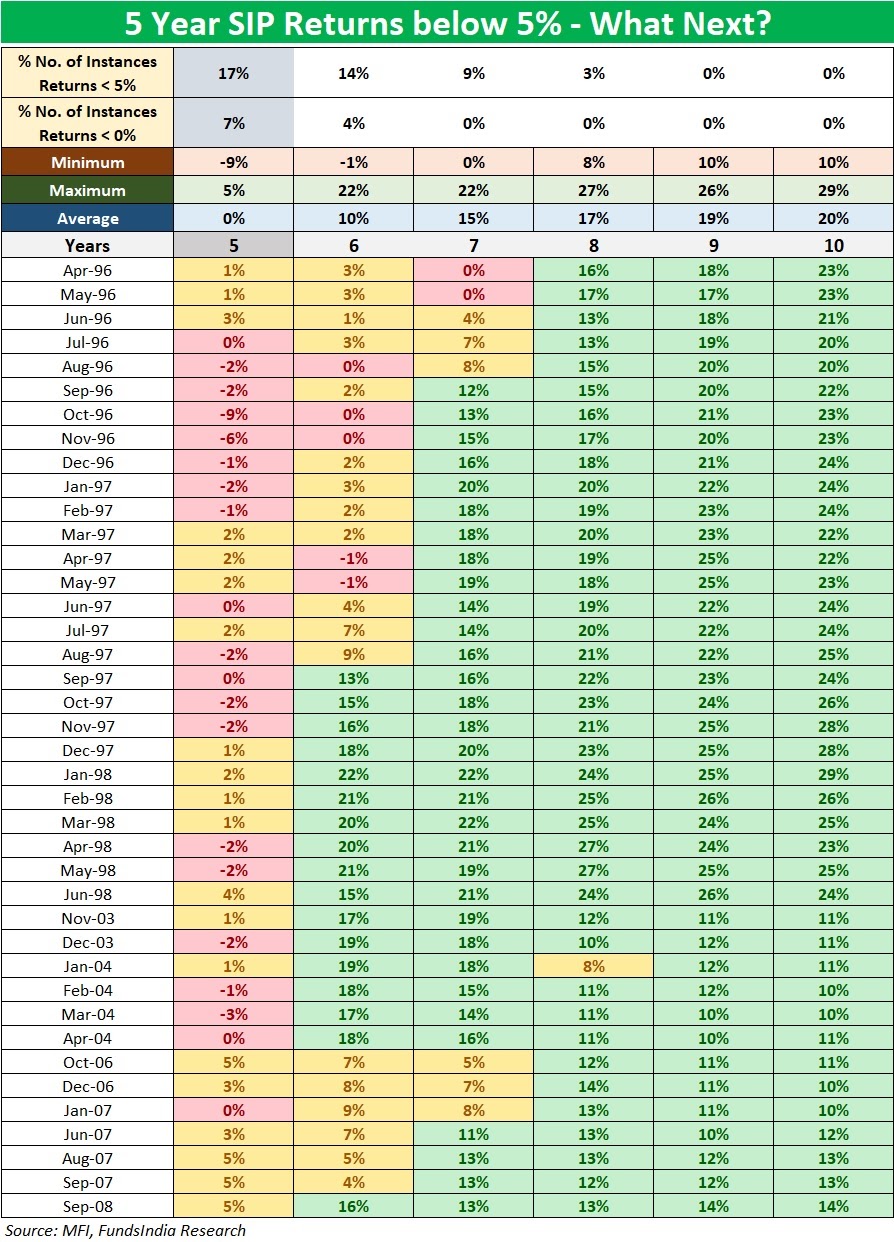

We have gone back 25 years in time (since 1995) and analysed the long-term returns (5-10 years) for a monthly SIP starting in Jan-95, Feb-95, and Mar-95 and so on till this date.

Since 1995, there have been 40 months (17% of total instances), where a 5-year SIP in the Nifty 500 TRI index gave annualized returns of less than 5%.

- In 17 out of these 40 instances, when the SIP is extended for just one more year (i.e for a 6-yr SIP), the returns significantly improved to more than 13% and the average return was 18%

- For 15 out of these 40 instances, when the SIP is extended for two more years (i.e for a 7-year SIP), the returns significantly improved to more than 11% thus average return was 15%.

- In the remaining 8 instances, when the SIP is extended for three more years (i.e for an 8-year SIP), the returns significantly improved to more than 12% thus the average return was 14%

- While the occurrence of such 5-year SIP periods with muted returns is not very common, whenever they happened, investors who continued their SIPs for another 1-3 years without panicking, had a significant recovery in returns (to above 12%).

So, keep calm and stay invested, don’t sell your units because you are afraid of the market, rather wait for the market to get better and thus your returns will bounce back to normal.

And, what is even the point to take money out in the time of losses having patience might take you out of the loss you are incurring now.

Happy Investing!

(Mutual Fund investments are subject to market risk Illustrations are for example only, there is no guarantee of returns. Past performance is not an indicator/guarantee to future returns).