Greeting To All Our Readers!

NFO Alert-

“Aditya Birla Sun Life Asset Management Company Limited has launched a new fund offer for ABSL Business Cycle Fund. The fund is open for subscription between November 15, 2021, and November 29, 2021”

Read below for more details about the NFO!

Basic Details About The NFO…

- Fund Name- Aditya Birla Sun Life Business Cycle Fund

- Type- An open-ended equity scheme following business cycles based investing theme

- Subscription open date- 15th November 2021

- Subscription close date- 29th November 2021

- Benchmark- S&P BSE 500 TRI

- Minimum Amount for Application during NFO- Rs 500 and in multiples of Rs 1 after that.

- Minimum Additional Purchase Amount- Rs 500 and in multiples of Rs 1 after that.

- Minimum Redemption/Switch Amount- Rs 500 and in multiples of Rs 1 after that.

- Minimum SIP Amount- Rs. 500/- Minimum installments: 6

- Plans- Both Direct and Regular Plans are available

- Options Available- Both Growth and Income Distribution Cum Capital Withdrawal Option (ICDW)

Investment Objective…….

The new NFO launched is an open-ended equity scheme (sectoral/thematic).

The investment objective of the scheme is to provide long-term capital appreciation by investing predominantly in equity and equity-related securities with a focus on riding business cycles through dynamic allocation between various sectors and stocks at different stages of business cycles in the economy.

The new NFO aims to deploy the business cycle approach of investing by identifying economic trends and investing in the sectors and stocks that are likely to outperform at any given stage of the business cycle.

Exit Load Trends In The NFO……

The fund has no entry load however it has different terms for exit load listed below:

- If redeemed / switch-out units allotted before or on 12 months of allotment, 1% exit load will be charged.

- If redeemed / switch-out after 12 months from the date of unit allotment, no exit load will be charged.

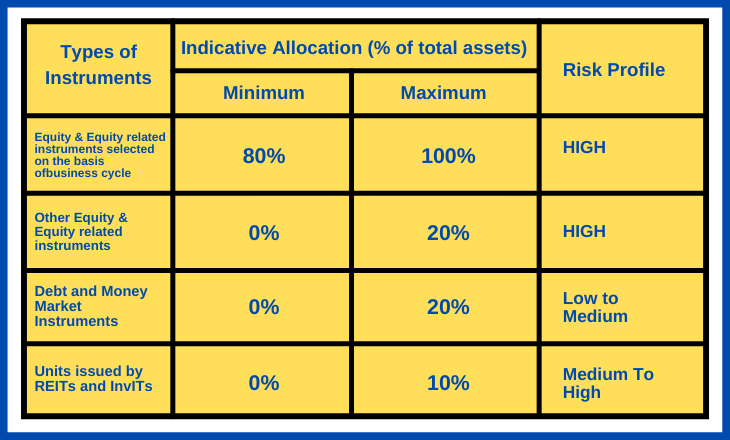

Asset Allocation Strategy………..

The investment policies of the Scheme shall be as per SEBI (Mutual Funds) Regulations, 1996, and within the following guidelines. Under normal market circumstances, the investment range would be as follows:

Fund Managers Of The NFO…….

The fund manager appointed to manage the asset allocation are-

Mr. Vineet Mahto: He holds experience of 17 years in financial services. Before joining ABSLAMC, he had been providing analytical support to the Chief Financial Officer of Hindalco Industries Limited, before which he had worked with Aditya Birla Management Corporation Ltd. & M/s. D. K. Chhajer & Co., Chartered Accountants.

Mr. Nitesh Jain: He also holds experience of 17 years in financial services He joined ABSLAMC in 2018 as Senior Analyst – Midcaps. He has been closely working with Senior Fund Manager(s) for research in Midcap and Small Cap stocks.

Who Should Invest In The NFO?

This product is suitable for investors who are seeking:

- Capital appreciation over a long period.

- Investments in a dynamically managed portfolio of equity and equity-related instruments.

Why You Should Invest In This New NFO?

Following are the reason or say specificity of the new NFO that attracts investors towards it:

- Make your portfolio conscious of business cycles

- Get a ‘first mover’ advantage through fund manager expertise

- Flexibility & Diversification

- Global exposure

- Potential for long term capital appreciation

Note: Investors should consult their financial advisers if in doubt about whether the product is suitable for them or you can also get in touch with our executives for more suggestions.

Keep reading our article and stay updated with the latest news about Mutual Funds!

For any kind of query, you can contact us at Shri Ashutosh Securities Pvt Ltd., we are here to help you in any way possible.

Happy Investing!

(Mutual Fund investments are subject to market risk Illustrations are for example only, there is no guarantee of returns. Past performance is not an indicator/guarantee to future returns).