Greeting To All Our Readers!

NFO Alert-

“HSBC Asset Management Company Limited has launched a new fund offer –HSBC Mid-Cap Fund. The fund is open for subscription between September 06, 2021, to September 20, 2021”

Read below for more details about the NFO!

Basic Details About The NFO…

- Fund Name- HSBC Mid-Cap Fund

- Type- An open-ended equity scheme predominantly investing in mid-cap stocks

- Subscription open date- 6th September 2021

- Subscription close date- 20th September 2021

- Benchmark- NIFTY Midcap 150 Index TRI

- Minimum Amount for Application during NFO- Rs 5000 and in multiples of Rs 1 after that.

- Minimum Additional Purchase Amount- Rs 1000 and in multiples of Rs 1 after that.

- Minimum Redemption Amount- Rs 1000/- and in multiples of Re. 1/- thereafter or account balance whichever is lower

- Plans- Both Direct and Regular Plans are available

- Options Available- Both Growth and Income Distribution Cum Capital Withdrawal Option (ICDW)

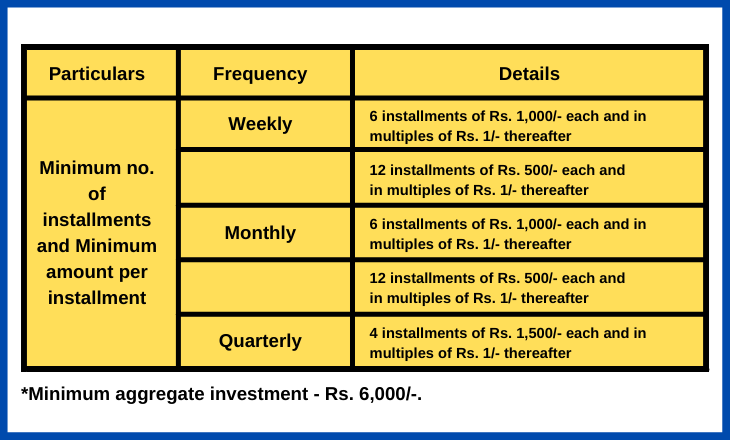

- Minimum SIP Installment-

Investment Objective…….

The new NFO launched is an open-ended equity scheme that predominantly invests in mid-cap stocks and seeks to generate long-term capital growth from an actively managed portfolio of equity and equity-related securities.

However, there can be no assurance that the investment objective of the Scheme will be achieved.

Exit Load Trends In The NFO……

The fund has no entry load however it has different terms for exit load listed below:

- Any redemption / switch-out of units within 1 year from the date of allotment shall be subject to a 1% exit load.

- No Exit Load will be charged if units are redeemed/switched out after 1 year from the date of allotment.

- No exit load (if any) will be charged for units allotted under reinvestment of IDCW option

Fund Managers Of The NFO…….

The fund manager appointed to manage the asset allocation in the new NFO is Mr. Ankur Arora. He holds experience of 16 years in Research and Fund Management.

Education: Mr. Arora has completed PGDM from IIM, Lucknow. He also has attained a certificate of CFA from the CFA Institute, USA.

Experience: Before joining HSBC AMC he has worked with Aegon Life Insurance, IDFC Asset Management Company Ltd., ING Investment Management, Macquarie Securities, and UTI Asset Management Company Ltd.

Who Should Invest In This NFO?

As per the experts, this NFO is more suitable for investors who are looking for:

- Long term wealth creation

- Investment predominantly in equity and equity-related securities of mid-cap companies

Keep reading our article and stay updated with the latest news about Mutual Funds!

For any kind of query, you can contact us at Shri Ashutosh Securities Pvt Ltd., we are here to help you in any way possible.

Happy Investing!

(Mutual Fund investments are subject to market risk Illustrations are for example only, there is no guarantee of returns. Past performance is not an indicator/guarantee to future returns).