Hello Readers!

Getting yourself financially prepared for your post-retirement expenses is equally important to your financial preparation for other intermediate goals. In addition, with the rise in life expectancy rate, creating a big corpus retirement becomes more essential for a happy retirement day!

No doubt, people today are more aware and they do start saving and investing for their retirement in their early years of career. However, while planning their investment for retirement, investors often commit kind of financial mistakes that adversely affect their retirement goal.

Here we are discussing such mistakes, understand and best try avoiding them while planning your investment for post-retirement expenses.

Never Underrate The Size Of Your Retirement Corpus….

People when calculating their retirement corpus, often compare retirement expenses with their regular expenses. They consider that their monthly expenses after retirement would be much less than the regular expenses they carry out now monthly, as after retirement, there will be traveling expenses (while commuting to their workplace), children's education expenses, and others.

While certain regular expenses might get erased out after retirement but some other charges get included, mostly the healthcare expenses. After retirement, the higher possibility of getting diseases and sustaining injuries in old age can lead to a sharp increase in healthcare expenses.

Another mistake they do while calculating their retirement corpus is not considering the increasing inflation. This can increase the possibility of exhausting the entire corpus within your lifetime.

And the third factor that they skip is taking into consideration the longevity of their retirement. This might result in the risk of outliving their retirement corpus.

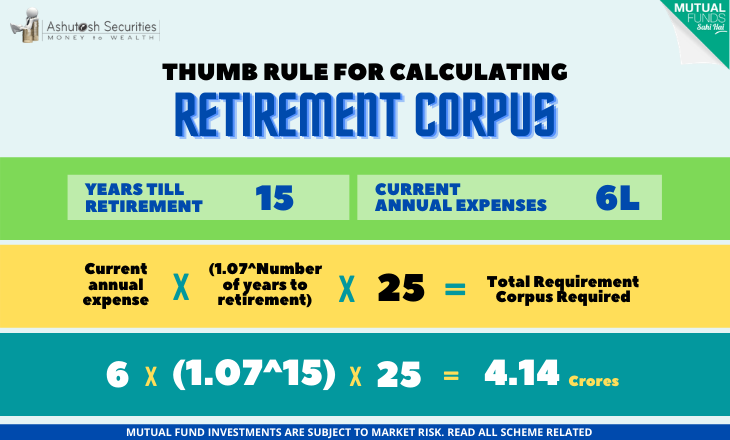

Basically, while you calculate your retirement corpus, do consider the three most important factors, possible expenses after retirement, how long your retirement life would be, and the increasing inflation. This way you can calculate your retirement corpus in the best way.

Below is a picture that depicts the thumb rule for calculating retirement corpus.

Early You Start, The More You Create…

You work for 30 years, within the same time period, you have to save, invest, and create enough corpus to spend another 30 years of your life smoothly without any financial problem. This is why it is recommended to start saving and investing for your retirement once you start earning. The early you start investing, the more you end up creating, with very minimal strain on your other necessary expenses.

The late you start saving and investing for your retirement, the higher would be the chances of accumulating an inadequate corpus and/or straining your finances for other money goals in the later work-life stages.

If you start late investing for your retirement you would require a large sum of SIP installment to create the desired retirement corpus. For example- a 30-year-old can build a post-retirement corpus of Rs 1.5 crore within the next 30 years through a monthly SIP of just Rs 4,300 in equity mutual funds, assuming an annualized return of 12 percent. However, the same person if start investing at the age of 45 building the same corpus at the same rate of return over the next 15 years would require a monthly SIP investment of about Rs 30,000. And dear there is a big difference between Rs 4300 and Rs 30000!

Do Not Skip Reviewing Your Retirement Portfolio At Intervals…

While investors start investing for their retirement, they often pick up the top-performing funds, that also have delivered good returns in the past. However, it is not guaranteed that the fund will give the same outperformance in the future also. Various factors prevailing in the market like changes in fund management style impact the performance of the fund in the future.

Thus, it is important to keep reviewing your portfolio and do the necessary asset allocation changes if required, at fixed intervals, say at least once in a financial quarter. While you review the performance of the fund in your portfolio, consider its output against its benchmark, it would be much useful in deciding the quality of the fund.

Stay Invested A Part In Equity Fund Even You Reach Retirement…

Investors when they are near reaching their retirement, gradually start shifting their entire post-retirement corpus from equity funds to debt funds or other fixed income instruments, just to give stability to their retirement corpus. However, redemption strategy for retirement corpus has been defined differently by the experts, they say:

- Once you near your retirement age, estimate your mandatory living expenses for the next seven years and redeem that amount from your post-retirement corpus for investing in fixed income instruments such as short-term debt funds.

- Keep the rest of the retirement corpus invested equity mutual funds for wealth creation.

The investments in an equity fund will continue creating corpus, this will help your retirement corpus to outlast your lifespan.

Keep reading our articles for more updates on finance and investment!!

For any kind of query you can contact us at Shri Ashutosh Securities Pvt Ltd., we are here to help you in any way possible.

Happy Investing!

(Mutual Fund investments are subject to market risk Illustrations are for example only, there is no guarantee of returns. Past performance is not an indicator/guarantee to future returns).