Hello Readers!

Blue-Chip Mutual Funds or large-cap mutual funds invest in companies with big market capitalization. Generally, these companies have established businesses that have a proven track record. They run on established business models and are leaders in their industry. They are companies that pay a consistent dividend to its shareholders.

Investors planning their investment in mutual funds often have a question is it necessary to add large-cap mutual funds or blue-chip mutual funds to one’s portfolio? And if it is necessary then how do these funds benefit its investors?

Well, Bluechip funds or large-cap mutual funds, provide both stability and growth to one’s portfolio. They have the potential to withstand market volatility and give stable returns to their investors. Also, the investor’s capital to grow along with that of the company.

Let’s look at the factors that determine why an investor should include Blue-chip funds in their portfolio.

Diversification Of Risk

Companies with big market capitalization have diversified businesses, due to which its portfolio across different demographics and geographies, is associated with low risk. The risk in these companies is considerably less, thus the risk of investing in large-cap mutual funds is low when compared to its counterparts, mid or small caps.

Financially Strong

The market capitalization companies are taken as the leader of the market in their industry. Their share price is prone to less volatility due to a well maintained financial position. Thus, blue-chip or large-cap mutual fund investing in these companies have high growth and return.

Consistency in Dividend Payouts

Investors who invest in dividend plans of large-cap or blue-chip mutual funds, enjoy the benefit of consistency in their dividend payouts, as these companies with big market capitalization pay regular and consistent dividends. Large-cap mutual funds that invest in blue-chip companies are a good source for regular income.

Who Should Invest in Blue-Chip or Large-Cap Funds?

Investors who have low risk and is conservative towards taking high risk, but at the same time is looking to create wealth without taking too much risk and volatility, this investor should consider investing in blue-chip or large-cap mutual funds.

The large-cap companies in which large-cap fund assets are invested, maintain a proficient and consistent performance during the market fluctuations, this makes the large-cap funds a suitable investment option for investors with the moderate risk profile and for new or first-time investors.

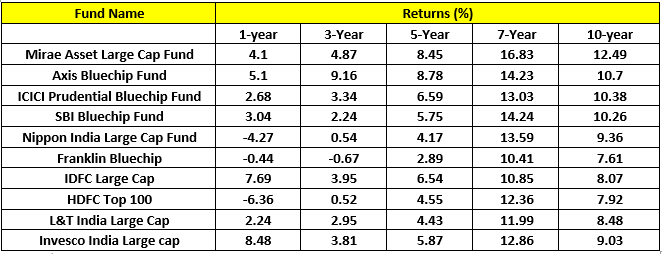

Here are top-performing Large-cap mutual funds of 2020:

#As of 17th august 2020

For any kind of query, you can contact us at Shri Ashutosh Securities Pvt Ltd., we are here to help you in any way possible.

Happy Investing!

(Mutual Fund investments are subject to market risk Illustrations are for example only, there is no guarantee of returns. Past performance is not an indicator/guarantee to future returns).